Investment Perspective: Thoughts on the Current State of Play

The sun rises above the Pacific Ocean in this photograph from the ISS as it orbited 259 miles above and about 500 miles north of Hawaii.

Media Credit: NASA

March 27, 2025 • By Sven Eenmaa, ISS National Lab Chief Economist

With the busy first quarter of 2025 almost behind us, it is time to share some thoughts on the current capital market environment and outlook.

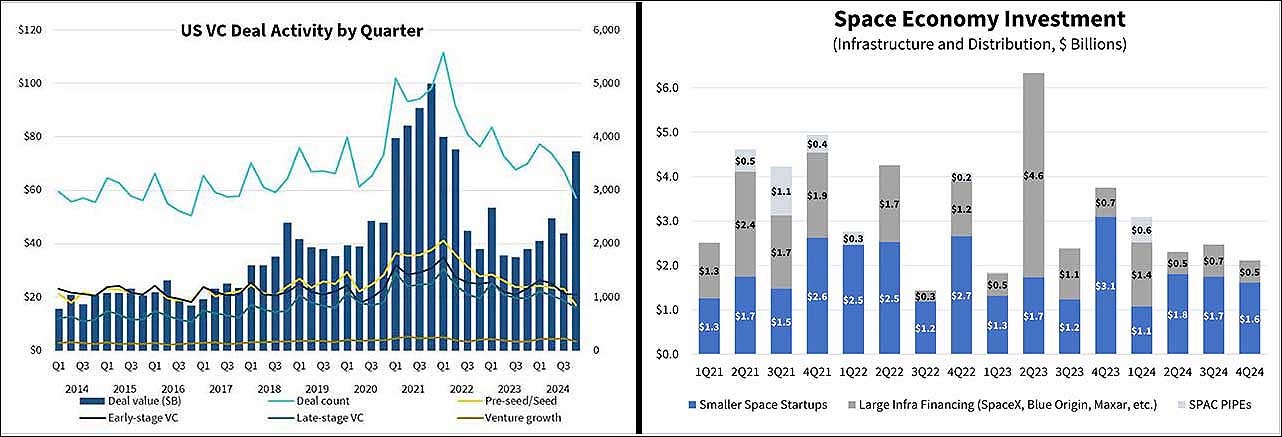

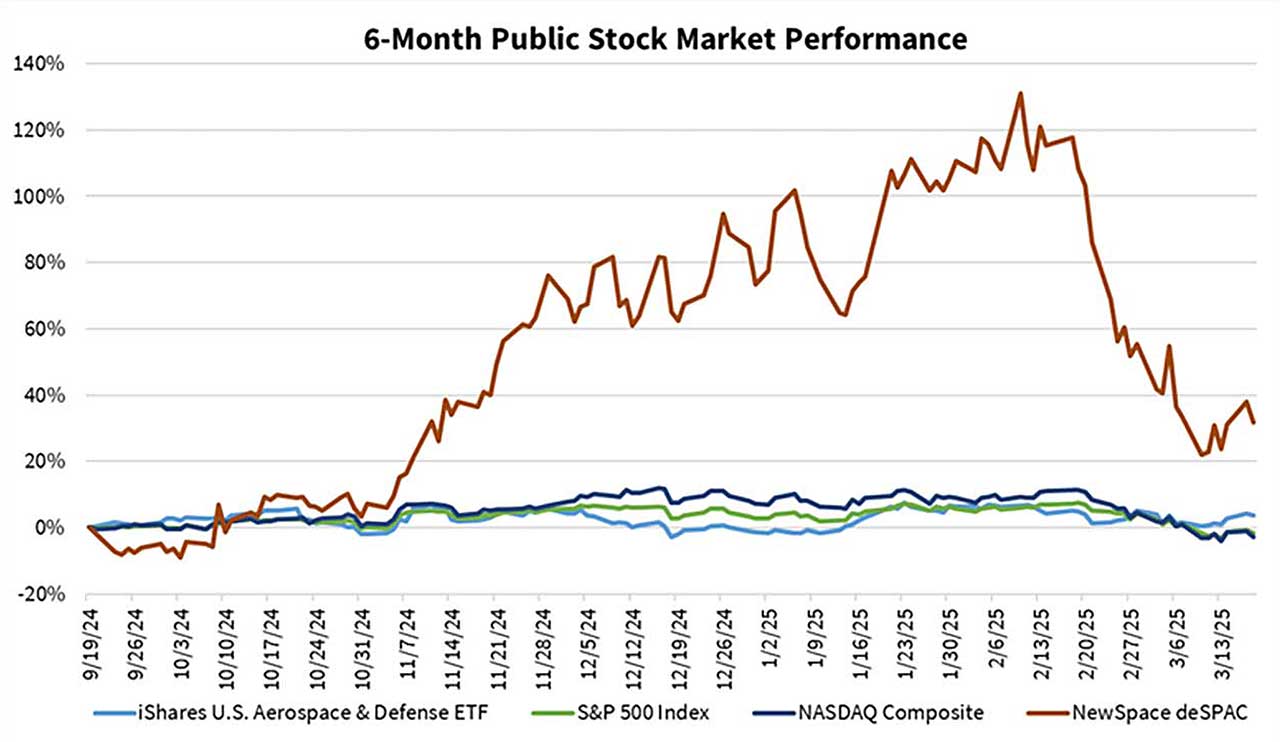

Reflecting on our post-election conversations with investors, the administration change was largely viewed as positive for the growth of the space industry and access to capital. This initial optimism was particularly visible in deSPACed NewSpace stocks, where valuations more than doubled over a one-month period post the election. In the December quarter, we saw a rebound in the broader U.S. venture capital markets with the highest investment activity in 10 quarters. The overall space sector capital raising volumes remained stable in 4Q24 versus prior quarters, in line with our expectations of the industry reaching a “new normal,” where capital is still available, albeit at higher performance hurdle rates.

Media Credit: Pitchbook / NVCA, Space Capital

The initial post-election optimism has now been followed by volatility on the broader public financial markets, resulting from already visible impacts and further risk anticipation around the structural and policy changes from the new administration. The DOGE-driven cost reduction efforts and government RIFs, potentially inflationary impact of trade tariffs, pressures on budgets, and geopolitical direction changes are all adding uncertainty and delaying corporate hiring and capital investment decisions as well as dampening the near-term consumer spending outlook. As a result, it is not surprising that investors are now questioning the broader economic growth expectations and justifications to current financial market valuations. A more sustained acceleration of access to venture capital and private equity funding remains subject to the opening of public markets for new equity issuance and well as increased merger and acquisition activity. The current level of uncertainty poses a near-term headwind here as well, although, we have seen some encouraging announcements recently. In the space sector, we have already seen a partial unwind of the post-election gains.

Note: NewSpace deSPAC index includes ASTS, BKSY, LUNR, MNTS, PL, RDW, RKLB, SATL, SPCE, SPIR, VLDX on an equally weighted basis

Media Credit: NASDAQ stock price data as of 3/18/25

When it comes to the impact on ISSInternational Space Station National Lab-supported early-stage companies and technologies, it is important to remember that the value creation potential reaches well beyond the near-term economic conditions. This is particularly true, as the focus here is on innovation that has potential to disrupt existing markets or serve sizeable unaddressed opportunities. Fundamental tailwinds for space industry growth remain intact. That being said, the consistency in demand signal from the government, as well as the availability of funding and infrastructure to support space-based R&D is essential, particularly at the current stage of industry evolution. The impact here is not just on the entrepreneurs developing, maturing, and deploying their technologies in space, but also on the whole ecosystem of specialized technology, infrastructure, and service providers supporting the still emerging space economy segment on platforms such as the ISS.

As a reminder, the ISS National Lab works with 33 companies that serve as Implementation Partners of awarded projects, and there are 23 commercial facilities on the ISS. If some of this governmental support or capability is removed, there is a significant risk that the technology and business maturity needed to unlock the targeted economic and societal value creation will not be achieved. In the current environment, uncertainties have increased regarding the timing of support in areas such as grant funding; however, so far, this appears to be more of a nearer-term constraint than something that would alter the trajectory of the low Earth orbit(Abbreviation: LEO) The orbit around the Earth that extends up to an altitude of 2,000 km (1,200 miles) from Earth’s surface. The International Space Station’s orbit is in LEO, at an altitude of approximately 250 miles. economy for good. Our upcoming Space Symposium conversations will provide further insights on the impact on our ecosystem.

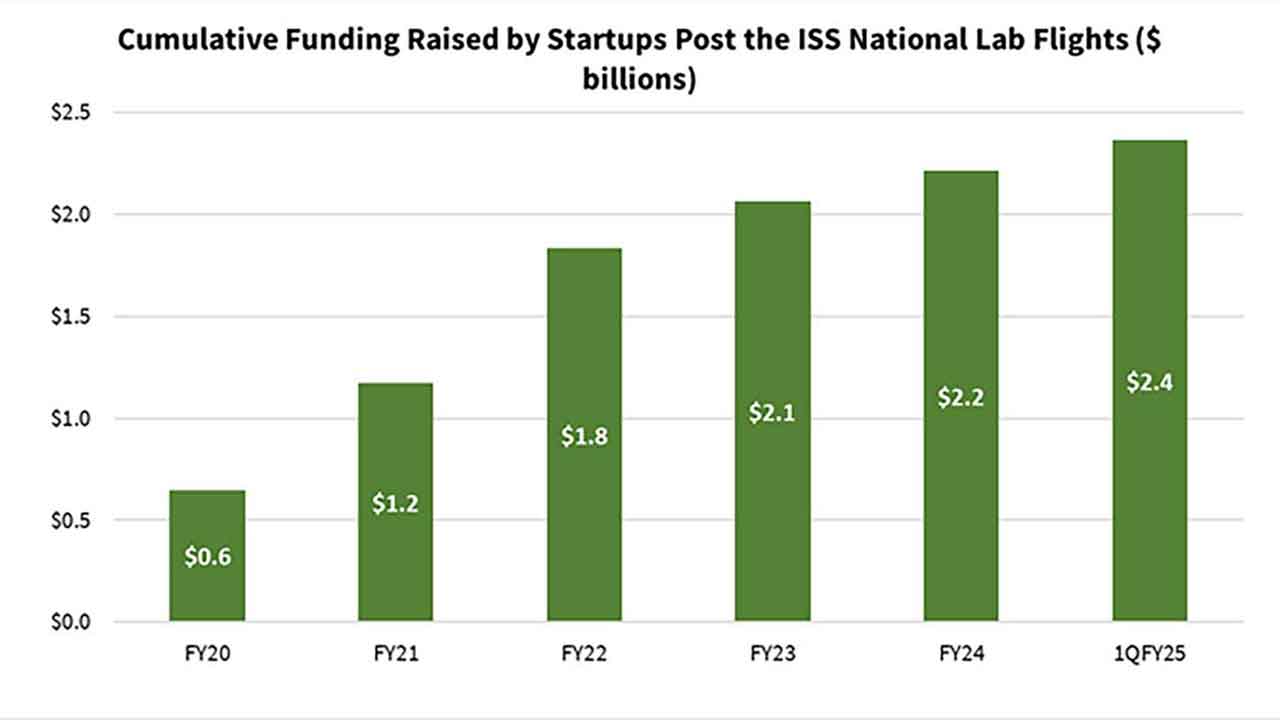

The December 2024 quarter showed strong improvement in funding activity in the ISS National Lab’s startup ecosystem. Based on publicly available data, a total of $146.4 million of private capital and grant funding was raised during the quarter by startups that have completed a flight project with the ISS National Lab. This is the highest quarterly result over the past 12 quarters and is comparable to the funding activity during the whole preceding fiscal year. To date, close to 100 early-stage startups have been awarded ISS National Lab-sponsored projects, and more than $2.4 billion of such startup funding has been raised following project flight. We continue to see significant value creation opportunities here through our work with accelerators and investors.

Media Credit: Company public reports and regulatory filings

We anticipate continued positive investor traction as we progress through 2025, albeit with volatility from quarter to quarter until the uncertainty around structural and policy changes subsides. Reduced regulation and taxation under the new administration, as well as increased focus on geopolitical competitiveness, could drive additional economic growth and be a tailwind for financial market activity. However, it is unclear when exactly these growth factors will start to outweigh the current uncertainties in the overall investment sentiment. The timing here is likely tied to tariff and budgetary developments and resulting spending profiles, perhaps within a three- to six-month period, although more sophisticated investors will change their positioning in anticipation of major announcements.

From our perspective, the space industry’s value creation opportunities remain significant; however, the volatility in the funding environment needs to subside to unlock the industry’s full innovation potential. For investors with available capital and sufficient risk appetite, the current environment is likely to provide attractively valued entry points.