« Back to Annual Report for Fiscal Year 2025

LEO Economic Development: Investor Network and Capital Connections

MEDIA CREDIT: Image courtesy of NASANational Aeronautics and Space Administration

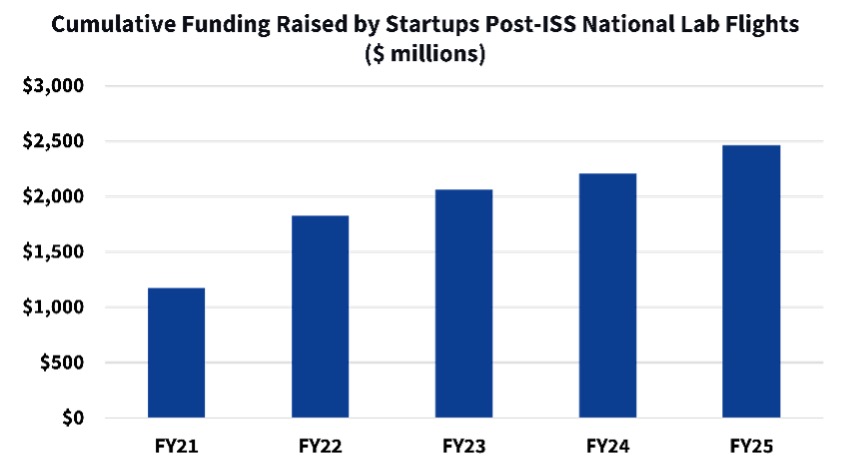

The ISSInternational Space Station National Lab’s startup ecosystem remained strong this year, despite challenging capital market conditions and budgetary uncertainties. Many startup companies that have leveraged the ISS National Lab to advance their R&D had successful fundraising activities in FY25.

- The total funding raised this year by startups after completion of ISS National Lab flight projects was $251 million—an increase of more than 70% compared to last year. The all-time cumulative total of such funding is now nearly $2.5 billion.

- When including startups selected for future spaceflight projects that have not yet launched, the funding total for this year rises to close to $270 million, and the all-time total is nearly $2.7 billion.

- Capital raising activity in the ISS National Lab startup ecosystem included a broad range of early-stage companies, including Axonis Therapeutics, Aphios Corp., Space, Eascra Biotech, Encapsulate, EnduroSat, FluxWorks, GITAI, iXpressGenes, Kall Morris Inc., Lynk Global, Orbital Sidekick, Orbit Fab, Opterus, Rendezvous Robotics, Sachi Bioworks, SatRev, SQUID3 Space, Tympanogen, and Xheme.

- The ISS National Lab investor ecosystem, which includes 331 participants across financial and corporate investment organizations, remains a source of capital connections and potential future funding for early-stage companies planning studies on the ISS.

“The new Orbital Edge Accelerator is providing in-space testing opportunities and private venture funding to promising startups working in critical technologies, allowing them to accelerate their development. This helps guarantee U.S. leadership in these areas important for the successful development of a self-sustaining commercial space economy as well as for national security and resilience. The first edition of the accelerator was a tremendous success, with over 150 applications received. We look forward to continuing working with our partners at ISS National Lab for many years to come, including after a transition from the ISS to future commercial space platforms.”

– Raphael Roettgen, Founding Partner of E2MC Ventures

This year, the ISS National Lab debuted the Orbital Edge Accelerator Program, an initiative designed to integrate investment partners and cutting-edge startups into the rapidly expanding space economy.

- In partnership with global investors Cook Inlet Region, Inc. (CIRI), E2MC Ventures, and Stellar Ventures, six innovative startups were selected for the program’s inaugural cohort. Each received $500,000 in investment funding and the opportunity to conduct research on the ISS.

- The accelerator engaged 84 mentors to provide the startups with valuable mentorship sessions and curriculum programming toward development of their flight projects and building their business operations. Sessions were held in Alaska; Washington, D.C.; and Los Angeles, along with virtual mentor sessions and curriculum events. The program also included several well-attended investor and industry networking events on the east and west coast as well as a demo day in San Francisco.

- To execute the 18-week accelerator program, the ISS National Lab partnered with TechConnect, which has more than 25 years of experience connecting innovators with high-value commercialization opportunities.

The fiscal year ended in a capital markets environment where investor sentiment remained positive despite the volatility in 2025.

- The S&P 500 Index was up 14% year-to-date through mid-November, following a total return of 25% in 2024 and 26% in 2023. For the more technology stock-heavy NASDAQ Index, the metrics were 19%, 25%, and 54% respectively, with appreciation heavily driven by growth expectations and related infrastructure needs around all things AI. Some financial market participants have raised questions around the return on capital and overspending on AI-related investment, and there have been some jitters around broader economic growth readings. However, despite recent market volatility, there appears to be more positivity than caution reflected in the current market sentiment.

- With the rebound of market risk appetite during 2025, we saw internal public offerings (IPOs) from space and defense companies such as Firefly Aerospace and Voyager Technologies. We also now see news on SPAC (special purpose acquisition company) financings making a return as a funding structure. That being said, looking ahead to 2026, one should question the likelihood of continued appreciation in public market valuations at double-digit rates, and well above broader economic growth rates, for the fourth year in a row. In recent history, such lengthy double-digit per year return performance was achieved in the 1995-1999 period, followed by a substantial correction.

- When it comes to the private capital markets, such as venture capital, the trends tend to lag public markets. Current indications of increased IPO and mergers and acquisitions (M&A) activity, both of which have been improving in 2025, are typically viewed as a positive as they point to increased liquidity events to realize financial returns on prior years’ investments.

- Based on NVCA/Pitchbook data, U.S. 2025 venture capital deal activity is shaping up to be the highest since 2021. However, more than 64% of venture capital dollars have been going toward AI companies. Defense tech investment activity has remained strong through 2025, driving solid investment interest in parts of the space technology ecosystem. Space economy funding activity data from Space Capital points to a pace of funding for space infrastructure and distribution companies in 2025 that is likely to surpass 2024 levels.

- In terms of fundamental demand drivers, we do not see the defense and dual-use-driven demand for space innovation abating. Given the multipolar geopolitical environment and growing contestation over the space domain, we expect a solid investment appetite for relevant space technologies, absent broader financial market shocks. We also do not see communications or data processing needs subsiding any time soon. With AI-driven advances in areas such as remote sensing and Earth observation, as well as therapeutics and materials development, we could see additional demand tailwinds. Innovation in robotics and manufacturing should support favorable cost trends in the space industry. Advancements with launch platforms such as New Glenn are very encouraging as well.

- The question here is clearly not in the long-term value proposition, but rather in how these very promising advancements should be valued in the current financial market context.