Investment Perspectives: Expect Gradual Broadening of Investment Mix

Orbital nighttime peeks through the International Space Station's cupola, or "window to the world."

Media Credit: NASA

June 18, 2024 • By Sven Eenmaa, Director of Investment and Economic Analysis for the ISS National Lab

As we approach the mid-2024 mark in the space industry, we are seeing signs of stabilizing capital access following post 2021 downturn. We also see signs of gradual broadening of the investment mix, building on the more mature areas of the industry as well as incorporating learnings from the prior cycle. The industry’s secular growth drivers remain intact, and we are seeing record levels of orbital launches and smallsat deployments as well as exciting progress in areas such as Starship development and lunar landings. At the same time, the cost of capital for space startups remains high. So far, the return on investment in the industry has been a mixed bag.

The ISSInternational Space Station National Lab continues to have a rich pipeline of innovation, as interest from entrepreneurs and researchers remains strong. However, non-recurring R&D requirements remain high, indicating that government support remains crucial to reach technology maturity levels that are investable by private capital.

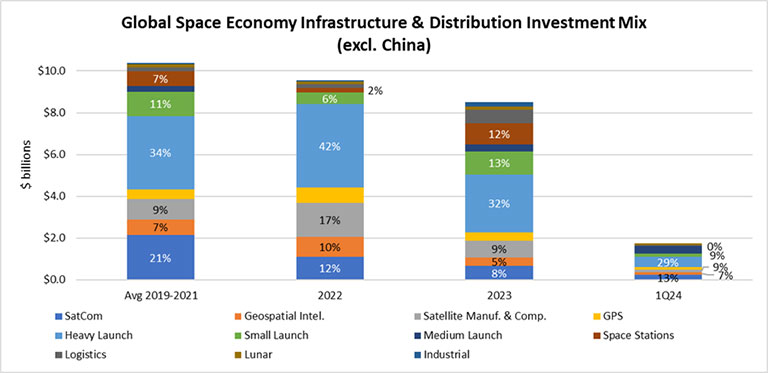

If we look at the space economy infrastructure and distribution layer investment activity from the past five years (Space Capital’s data, excluding large take private deals and China), we are seeing a modest but encouraging shift toward still small allocations to logistics, habitats, industrial applications, and lunar opportunities.

In terms of absolute dollars, the more mature sectors continue to lead the funding mix, but we do expect the range of private capital investable areas to continue to broaden. The pace of such broadening will depend on the outlook on user demand and maturity of underlying technologies, timelines and capital requirements to reach positive financial performance, and, in many cases, maturation of adjacent value chain capabilities in the space economy. In this context, it is exciting to see some of the innovation around both business models and technology approaches by infrastructure companies. For example, Vast Space has removed the early-stage financing risk (which is significant in the space industry) and materially reduced the technology capabilities risk, giving the company the ability to move faster than some of its competitors. Another example is Varda Space Industries’ already flight-proven approach with application-specific and vertically integrated capabilities that have lower upfront capital cost per vehicle, no human-tended vehicle overhead, and possibly higher flight frequency.

ISS National Lab-sponsored applied R&D projects often have promising initial results indicating significant possible market and competitive differentiation potential. However, getting from the initial results to a working product or manufacturing process may require significant additional R&D iteration in the environment of high technological complexity, which can be challenging to fund, particularly if timelines are uncertain. Expanding startup teams to encompass not only science and engineering skills but also the necessary commercial and operational execution capabilities is also not trivial. While several startups have been successful raising capital following their ISS National Lab flight projects, investor focus on a path to tangible revenues, and operational and business execution has clearly increased, as compared to mid to late 2010s’ emphasis on market and technology potential.

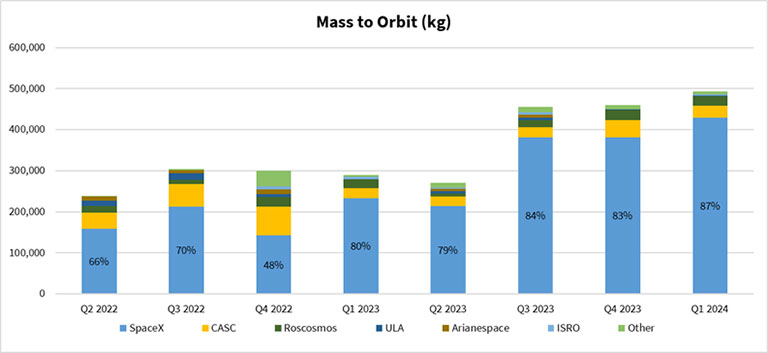

Further reductions in launch and transport costs remain essential to unlock new business opportunities in the space economy. Here, SpaceX holds an indisputable market leadership position, with 84% of mass to orbit over the last 12 months (BryceTech data). While there are “second source” providers on the market, it is clear who has the leading scale and drives the pricing. It is worth highlighting that geopolitical interests are supportive of duplicative regional investment in this sector, but we are seeing some consolidation of capabilities as well. SpaceX’s progress with Starship, which aims to more than double the capacity to low Earth orbit(Abbreviation: LEO) The orbit around the Earth that extends up to an altitude of 2,000 km (1,200 miles) from Earth’s surface. The International Space Station’s orbit is in LEO, at an altitude of approximately 250 miles. (LEO) via single launch as compared to Falcon Heavy and provide significant reductions in per -kg transport costs, will provide a step function change to access to orbit.

Satcom, one of the more mature subsectors in the space industry, is seeing disruption of legacy businesses and consolidation as well. Following a rapid deployment over the past five years, Starlink has now surpassed 3 million customers in more than 100 countries. Based on Quilty Space estimates, the company is likely to deliver $6.6 billion in revenue and more than half a billion dollars of positive free cash flow in 2024, implying rapid growth and self-sustaining operations. Other mega constellations such as Amazon’s Project Kuiper are likely to drive future changes in this market. Direct-to-device applications, where a shortlist of potential providers has emerged, is poised to expand the addressable opportunity further, and the increased low latency, broadband capabilities in LEO will open opportunities for new users and use-cases.

Outside of Satcom and GPS applications, which are heavily consumer and commercially driven, government demand remains essential for industry viability. For example, in Earth observation, where we are seeing new constellation buildouts and validation of the quality of commercially provided data, the revenue mix has remained more government-dependent than expected a few years ago. The efforts to reduce the cost of imagery and analytics and to increase ease-of-use in unlocking actionable intelligence for commercial markets remain in the works and continue to present a potentially investable opportunity.

Given the increasingly volatile, multi-polar geopolitical picture, combined with the recognition of space as an increasingly contested domain, the defense-related government demand for space tech and services is poised to continue its growth trajectory. We expect this demand to expand over time from transport, geospatial intelligence and related analytics, communications, sensing, situational awareness, and PNT (positioning, navigation, and timing), to a broader set of infrastructure elements, logistics, and operational capabilities, as relevant to defending national presence and interests. The obvious question is what this growth curve will look like across various application areas and what is the actual appetite to deploy commercial capabilities, as winning sizeable contracts and programs of record remains challenging, and budgets are not unconstrained.

Outside of defense-related spending, the government budgetary outlook is more challenging. Following a nearly 50% increase in the U.S. public debt since pre-pandemic levels coupled with interest rate increases, the high debt service cost remains a significant overhang for budgetary calculus for years to come. Beyond the reported near-term constraints on NASANational Aeronautics and Space Administration, this raises questions on the prospects of fundamental research and early-stage applied R&D in orbit, particularly as the industry transitions from the current ISS National Lab model at the end of the decade to a new national lab model using commercial facilities. For an external observer, it may not be clear just how indispensable the subsidized launch and space station capabilities are for the current, still nascent, orbital R&D and in-space manufacturing development efforts. If not properly addressed prior to the transition from the ISS to commercial platforms, there is real risk that the innovation pipeline the U.S. has built via the ISS National Lab will significantly diminish.

Join us at the 2024 ISS Research and Development Conference (ISSRDC(Abbreviation: ISSRDC) The only conference dedicated exclusively to showcasing how the International Space Station is advancing science and technology and enabling a robust and sustainable market in LEO. This annual conference brings together leaders from the commercial sector, U.S. government agencies, and academic communities to foster innovation and discovery onboard the space station. ISSRDC is hosted by the Center for the Advancement of Science in Space, manager of the ISS National Lab; NASA; and the American Astronautical Society.) July 29-August 1 in Boston. ISSRDC is the only conference dedicated to showcasing our nation’s orbiting laboratory and the growing market economy in low Earth orbit. To learn more about ISSRDC, including how to register, exhibit, and become a sponsor, please visit our conference website.