Investors at ISSRDC 2021: Positive on Opportunities, Focused on Performance

Looking from back to front, the International Space Station's Russian segment is pictured leading to the U.S. segment while orbiting 273 miles above the south Atlantic Ocean. At top right, is the Zarya module with the Rassvet module and the docked Soyuz MS-18 crew ship. The Canadarm2 robotic arm is seen next to the Tranquility module to which the cupola and BEAM, the Bigelow Expandable Activity Module, are attached. Two pairs of the station's main solar arrays are also seen descending from the orbiting lab's port side truss structure.

Media Credit: NASA

August 19, 2021 • By Sven Eenmaa, Director of Investment and Economic Analysis for the ISS National Lab

As has become a tradition at the International Space Station Research and Development Conference (ISSRDC), our 2021 virtual event provided insightful conversations with leading space industry investors. This year’s conference featured a panel session that included industry and capital markets perspectives from Thomas Gillespie from In-Q-Tel, Tess Hatch from Bessemer Ventures, Sunil Nagaraj from Ubiquity Ventures, and Eric Stallmer from Voyager Space Holdings, skillfully guided and moderated by Carissa Christensen from BryceTech. The presenters’ commentary covered the current state of the space industry’s investment environment and capital access, including the latest thoughts on special purpose acquisition companies (SPACs). The discussion also delved into various in-space trends and opportunities and provided thoughts on the government’s role in advancing the commercial space sector. Below we discuss some of the key takeaways from this panel session.

Investing in space and interested in learning more about the latest startups unlocking opportunities via the International Space Station U.S. National Laboratory? View a recording of our Investor Workshop for details.

Commentary points to broadening opportunities and favorable market conditions, but with some overheating concerns.

Per investor commentary, the range of investable opportunities in the space sector is continuing to expand. The 2021 capital access conditions have been highly favorable, with key events including the announcement of several space company public listings via SPAC transactions. These long-awaited exits to public markets have clearly caught the attention of the broader investor community, making additional earlier-stage capital available to space companies. The pace of innovation in the industry is strong, the range of startups from seed to growth stage is expanding, and the ecosystem to support them is increasingly robust. Some of the panelists described the current environment as “the right time to be investing” and “our time to shine.”

However, the current environment was also described as “frothy,” with increased questions raised on the quality and proof of actual business merits of some of the entities being funded. Panelists acknowledged that investors need to remain disciplined and focused on fundamental performance metrics to avoid the sector overheating, which in turn could lead to future public failures and subsequent cutbacks to the space sector’s capital access akin to the challenges faced in the 1990s.

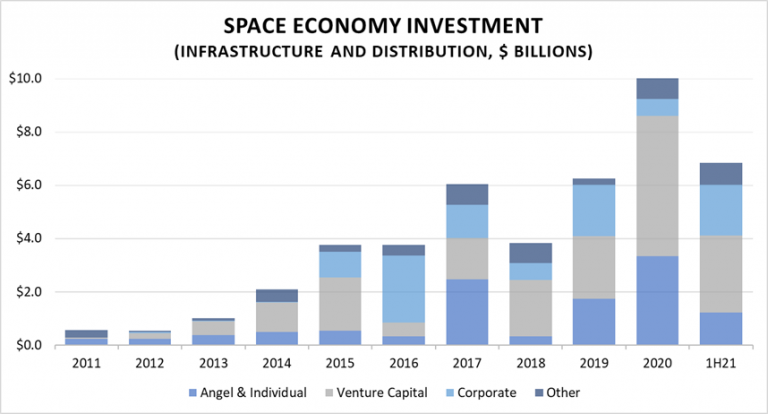

To provide additional context to our readers on just how robust the funding environment has been this year, we have included below the recently published data from Space Capital through the second quarter of 2021. Indicative of the pace of acceleration in capital inflows, the reported infrastructure and distribution segment totals solely in the most recent quarter exceeded the respective investment totals for the full calendar year of 2018, and the first half of 2021 investment totals exceeded the comparable metrics for the full calendar year of 2019.

Source: Space Capital data; CASIS(Abbreviation: CASIS™) The nonprofit organization that manages the ISS National Lab, which receives at least 50 percent of the U.S. research allocation on the International Space Station to facilitate research that benefits humanity (NASA manages the other 50% and focuses on research for space exploration purposes). analysis

Investors are warming up to in-space opportunities.

Regarding prospects for various business opportunities that target in-space activities, the investor commentary ranged from being very bullish to asking questions on the current maturity of such opportunities in terms of time needed to reach paying customers, revenues, and acceptable investment returns. In general, the views on the demand formation and outlook, as well as recognition of the potential size of the opportunity, are getting more positive compared with prior years. Some of the in-space activities mentioned include commercial destinations, orbital travel, satellite servicing, space-based manufacturing, logistics, and infrastructure. Panelists also discussed the potential of microgravity-based production, and while questions remain on what exactly can and will be produced, some early-stage companies in this field have been funded recently. From the perspective of venture capital time to market and return on capital, one of the key challenges yet to be solved is the speed and frequency of access and the potential for product iteration on the current and planned future low Earth orbit(Abbreviation: LEO) The orbit around the Earth that extends up to an altitude of 2,000 km (1,200 miles) from Earth’s surface. The International Space Station’s orbit is in LEO, at an altitude of approximately 250 miles. platforms. The recently demonstrated suborbital flight capabilities could potentially add a stepping-stone capability here.

SPACs are viewed as valuable for funding but need to demonstrate public equity returns.

The panelist commentary pointed to the significant value of SPACs in the space industry in creating well-needed access to capital and exits for earlier-stage investors. But investors also raised questions around the sustainability and longer-term impacts of the recent SPAC acquisition valuations, as well as the mixed quality of companies opting for such a public market entry strategy. The current capital-raising environment has remained favorable, and more exits are expected. However, over time, the public market performance of these newly listed companies will have an impact “upstream” in terms of the space sector’s ability to access seed and growth-stage venture capital. Given the regulatory and quality risks on the broader SPAC markets, this recent favorable environment could see some volatility going forward.

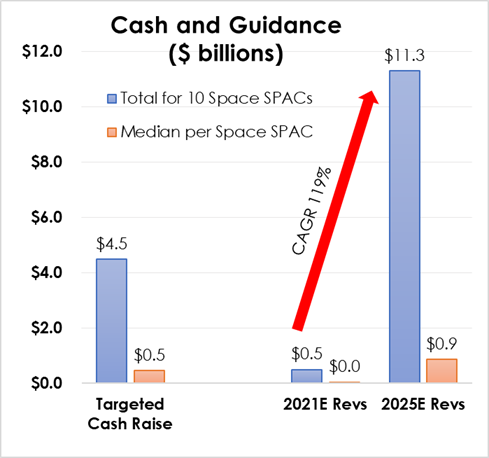

Source: Data from company presentations; CASIS analysis

If we look at the stock price performance of the space SPAC deals announced over the last 10 to 11 months, such balanced views appear justified. For the 10 space SPAC mergers announced since October 2020, which targeted a combined enterprise value of more than $16 billion (at the time of announcement), we have seen a combined intent to raise about $4.5 billion in cash. In turn, based on the companies’ estimates, this capital raising activity is expected to support a growth to a combined $11.3 billion in annual revenue and more than $5.7 billion of unlevered free cash flow by 2025. Such growth, if achieved, should imply significant shareholder value creation as respective businesses execute and de-risk the path toward their future financial performance.

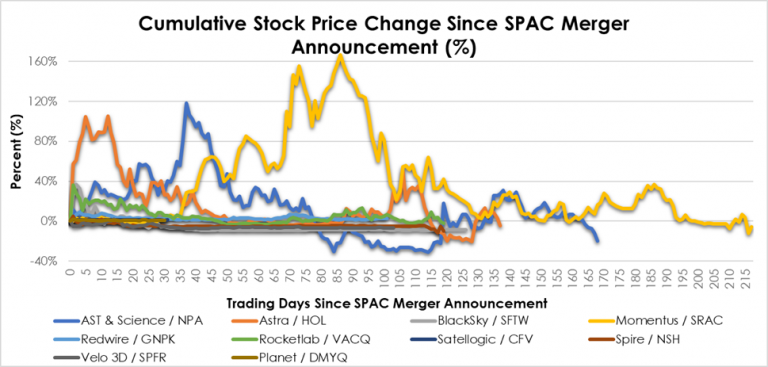

However, while the stock trading histories here have been relatively short and most of the mergers are yet to close, the stock price performance beyond the initial post-announcement pop has been lagging the broader market returns, implying subdued expectations by public equity investors, at least currently. While early investors expect the higher-quality businesses and execution capabilities to be recognized on the public markets, the onus remains on these newly listed companies to demonstrate shareholder value generation beyond the initial SPAC acquisition price.

Source: NASDAQ stock price data through August 17, 2021; CASIS analysis

The role of government and public-private partnerships remains a key consideration.

As during ISSRDC(Abbreviation: ISSRDC) The only conference dedicated exclusively to showcasing how the International Space Station is advancing science and technology and enabling a robust and sustainable market in LEO. This annual conference brings together leaders from the commercial sector, U.S. government agencies, and academic communities to foster innovation and discovery onboard the space station. ISSRDC is hosted by the Center for the Advancement of Science in Space, manager of the ISS National Lab; NASA; and the American Astronautical Society. in previous years, the topics of government role and public-private partnerships remain integral to the investor discussion. Per panelist commentary, the last six to seven years have delivered some maturation in how the government looks at the commercial space sector, including maturation in the role of a customer. While this remains a work-in-progress, it is a positive development for the commercial industry. There has also been progress made in recent years in reducing regulatory burdens and updating regulations to support the industry’s growth.

The panelists highlighted a further need for the government to improve the framework for its requirements related to space applications. This would include further maturation in acting as a customer with clear and not overly prescriptive requirements, which would allow the private sector to develop potentially cost-saving solutions that have a realistic opportunity to be purchased by the government and deployed to scale. There remains a need to further limit regulatory burdens, which in the worst case could suppress domestic innovation and create market entry opportunities for foreign rivals. Public-private partnerships continue to be viewed as the preferred way to leverage the commercial industry capabilities while meeting government mission goals, and possibly freeing up government resources for other purposes.

With that, we thank all the panelists for the insightful discussion!

A full recording of the panel session can be found in the on-demand section of the ISSRDC 2021 attendee hub. There is no cost to access the attendee hub and view the session; however, registration is required. To register for free, go to www.issconference.org. Additional information on the ISSInternational Space Station National Lab’s investor-related activities can be found at issnationallab.org/investment.