« Back to Annual Report for Fiscal Year 2024

LEO Economic Development: Investor Network and Capital Connections

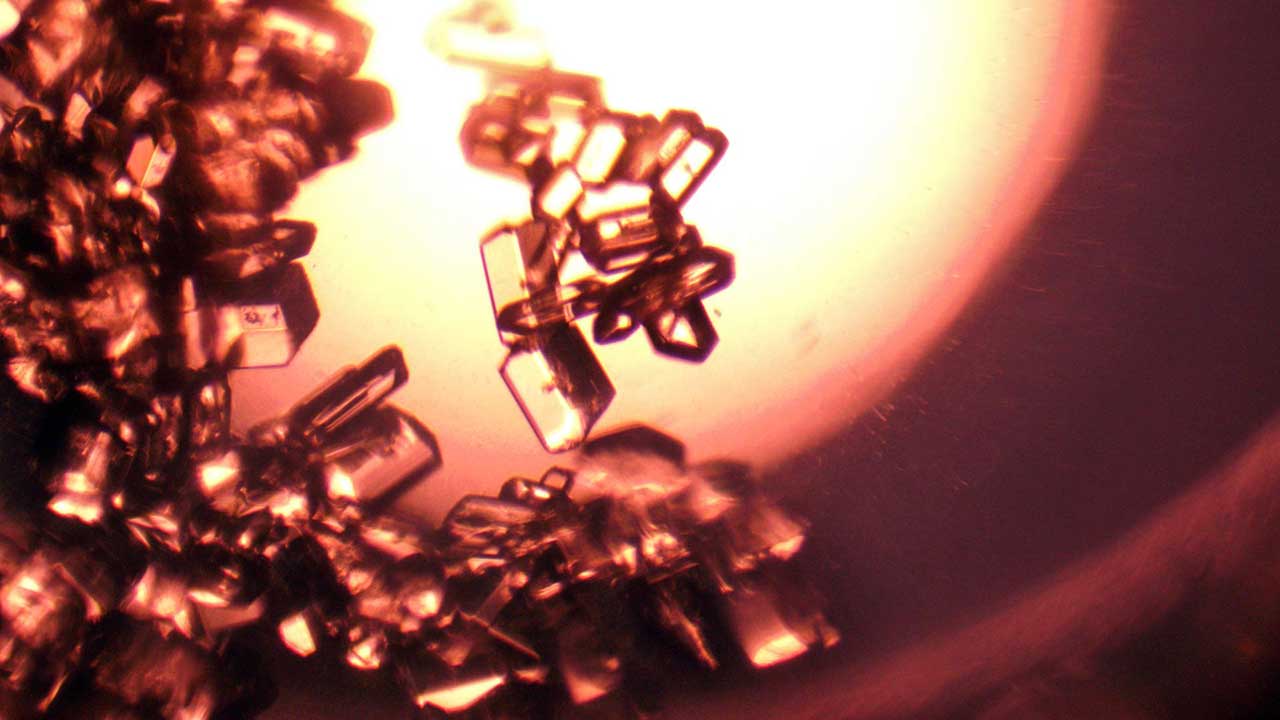

Glycine crystals grown with Redwire's PIL-BOX aboard the International Space Station.

Media Credit: Redwire Space

LEO Economic Development: Investor Network and Capital Connections

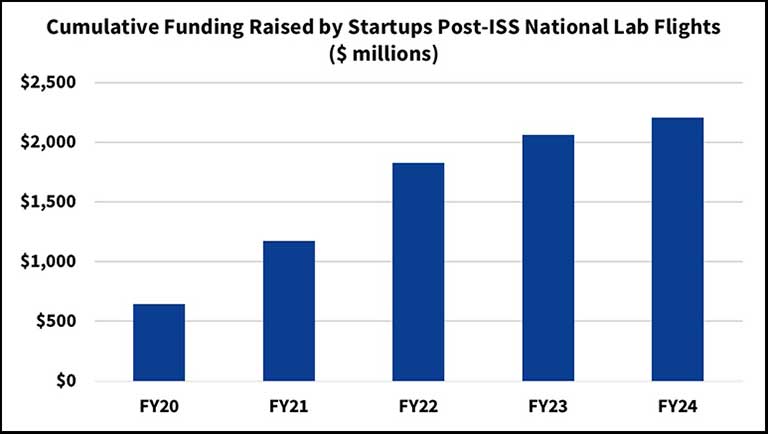

Several startup companies that have leveraged the ISSInternational Space Station National Lab to advance their R&D efforts were successful in fundraising activities in FY24, despite challenging capital market conditions. This year, the total funding raised postflight by startups with ISS National Lab flight projects amounted to nearly $147 million, bringing the all-time cumulative total to $2.2 billion. Including companies awarded a flight project that has yet to fly to the ISS, the respective total amounted to $155 million for FY24.

This year, capital raising activity from startups in the ISS National Lab ecosystem includes Cosmic Shielding Corporation, Exum Instruments, GITAI, LambdaVision, Lonestar Data Holdings, Lynk Global, RevBio, Revolution Space, SpaceBilt, Orbital Sidekick, Orbit Fab, and several others.

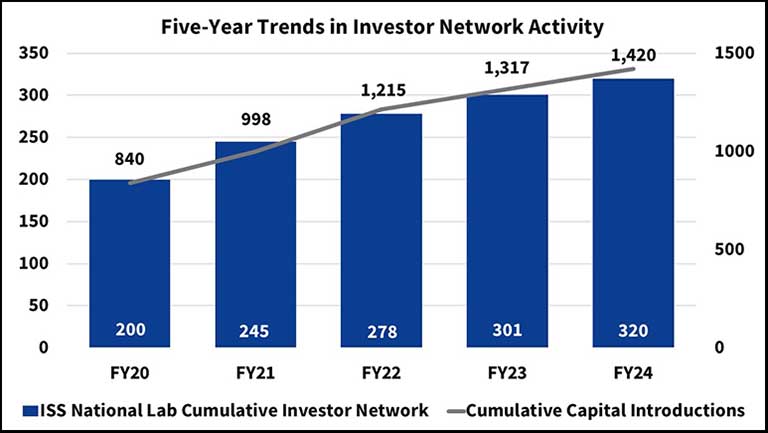

The ISS National Lab investor network now includes 320 financial investors, including venture capital, private equity, corporate, and angel investors. To date, CASIS(Abbreviation: CASIS™) The nonprofit organization that manages the ISS National Lab, which receives at least 50 percent of the U.S. research allocation on the International Space Station to facilitate research that benefits humanity (NASA manages the other 50% and focuses on research for space exploration purposes). has facilitated more than 1,400 capital introductions between startups and investors in the ISS National Lab investor network.

At ISSRDC(Abbreviation: ISSRDC) The only conference dedicated exclusively to showcasing how the International Space Station is advancing science and technology and enabling a robust and sustainable market in LEO. This annual conference brings together leaders from the commercial sector, U.S. government agencies, and academic communities to foster innovation and discovery onboard the space station. ISSRDC is hosted by the Center for the Advancement of Science in Space, manager of the ISS National Lab; NASA; and the American Astronautical Society. 2024, the ISS National Lab hosted its ninth annual investor event, showcasing seven innovative startups in the ISS National Lab ecosystem across the biomedical technology, aerospace, semiconductor, biomaterials, and manufacturing sectors. The event led to several new capital introductions and deeper conversations with investors and industry partners.

Industry Context

Following the peak of 2021 and subsequent financial market rationalization and volatility, the space industry funding environment appears to be well on its way to a “new normal.” In the current environment, capital is still available, albeit at significantly higher performance hurdle rates, and investors are much more discerning in assessing truly addressable markets and financial return potential.

Despite the lengthy reset on risk capital markets, the last 12 months highlighted several fundamental tailwinds for the space industry, which are supportive of continued innovation and investment. The demand for LEO(Abbreviation: LEO) The orbit around the Earth that extends up to an altitude of 2,000 km (1,200 miles) from Earth’s surface. The International Space Station’s orbit is in LEO, at an altitude of approximately 250 miles. communication capabilities remains strong, as demonstrated by hypergrowth at Starlink, geopolitical needs for proliferated constellation capabilities, as well as interest in direct-to-device services. The rapid advancements in AI are opening new opportunities in geospatial intelligence and analytics with the potential to tap into commercial demand, which so far has remained elusive. SpaceX’s continued progress with Starship and Super Heavy is moving the industry closer to unlocking business models that require more mass to orbit at lower cost. The increasingly challenging geopolitical environment, where space is viewed as a contested domain, is clearly a demand driver for relevant technological capabilities. Furthermore, the winners and losers of the 2021 special purpose acquisition companies’ initial public offering (SPAC IPO) wave, as it relates to the space sector, have become increasingly apparent, which provides valuation milestones for space companies that have strong value propositions and can execute on their operational and business milestones.

“We have continued to see healthy growth within the space sector despite the contraction in the general venture market in the last few years. One segment we are particularly excited about is the in-space pharmaceutical market. The ISS National Lab plays a significant role in providing these businesses the tools to derisk their technologies, making them far more investible for us.”

– Lewis Jones, Generation Space

Based on post-election conversations with investors, the upcoming administration change is largely viewed as positive for the growth of the space industry and access to capital. A more sustained acceleration of access to venture capital and private equity funding remains subject to the opening of public markets for new equity issuance and well as increased merger and acquisition activity. This would return capital to earlier-stage investors, allowing them to reinvest the proceeds in promising new enterprises. Reduced regulation and taxation under the new administration, as well as increased focus on geopolitical competitiveness, depending on the extent delivered, would drive additional economic growth and be a tailwind here. The picture is less clear when it comes to more restrictive international trade policies and any near- to intermediate-term revisions to government spending. Investors would need to weigh resulting impacts on near-term domestic demand versus long-term impacts to U.S. manufacturing capability and national debt levels.